Director Fee Need To Pay Socso

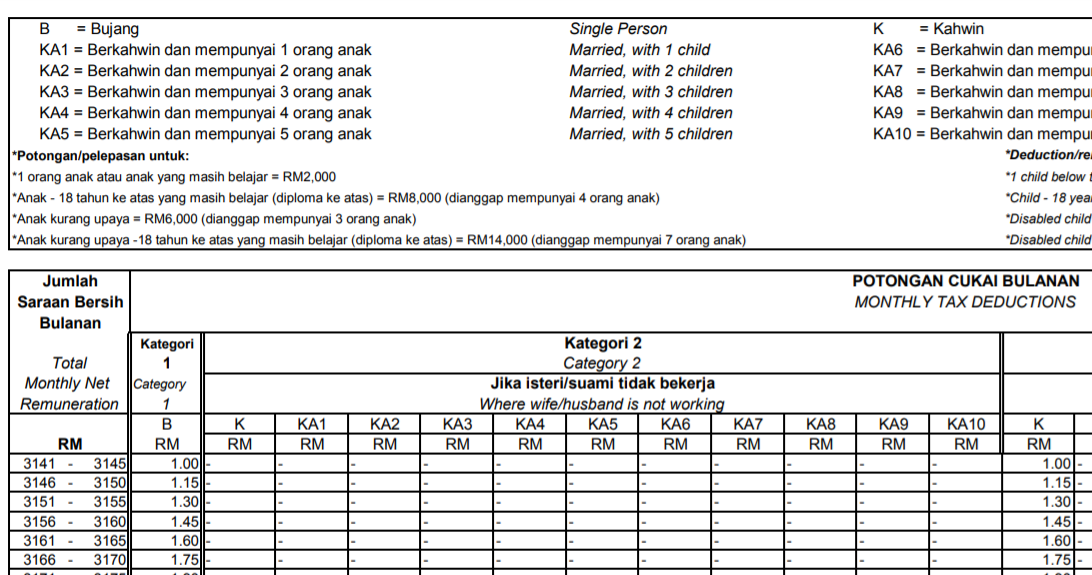

Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator.

Director fee need to pay socso. How about non executive director. Apr 21 2015 11 44 am. You need to give numbers for people advise accurately.

Do director need to contribute socso. If you need more flexible and better payroll calculation such as generating ea form automatically or adding allowance that does not contribute to pcb epf or socso you may want to check out hr my free malaysian payroll and hr software which is absolutely free. He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee.

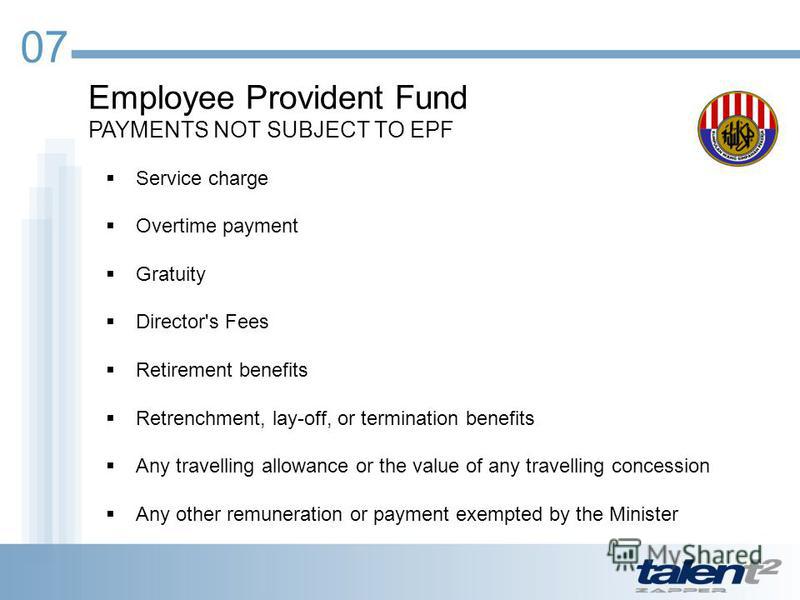

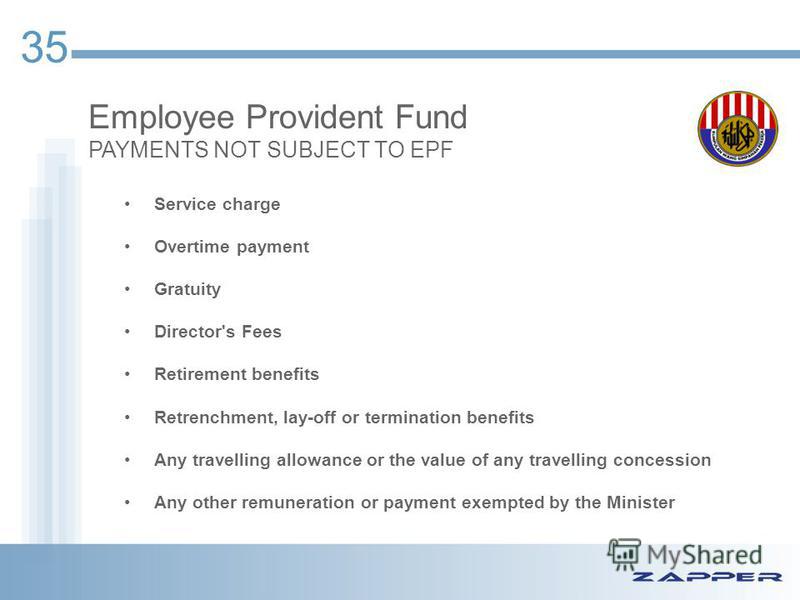

Wages subject to socso contribution. Wages or salary payment subject to socso contribution recommended. Employers need to obtain consent from employees in accordance with the provisions of section 44 of the epf act before the transfer of retirement benefits.

Since you have secure your income you need to start to have proper tax planning. Employers are legally required to contribute epf for all payments of wages paid to the employees. Show posts by this member only.

Director salary bonus have to combo with kwsp which is good in a way that kwsp is tax exempted. If the employer fails to contact the employee and have applied for retirement benefits to be credited to employee s account at epf employers are required to complete and sign the undertaking and indemnity letter of transfer of employee. Try fully utilize sdn bhd lower band tax of 19.

Not all wages payments to staff workers are subject to socso contribution and there are certain wages excluded from socso contribution. For further clarification on definition of wages kindly contact socso offices or customer service careline at 1 300 22 8000. Forever for unlimited employees.

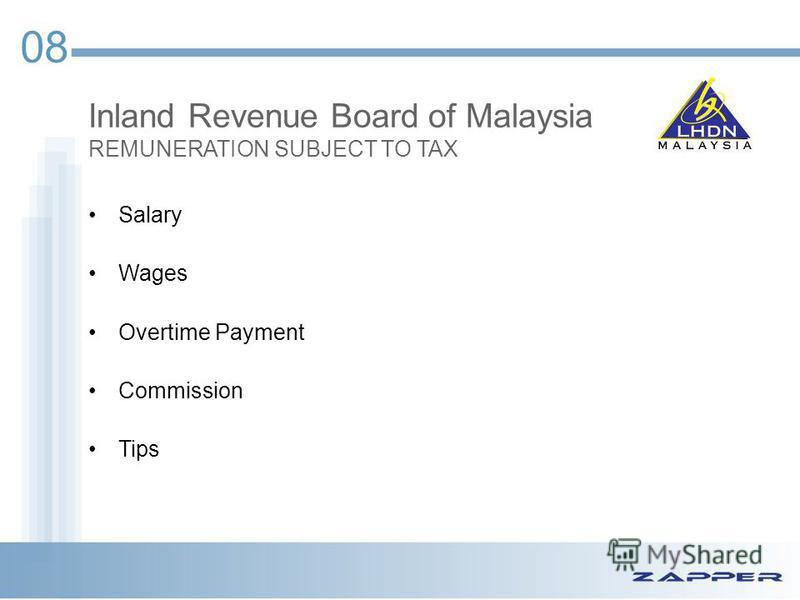

Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. Which payments are subject to socso contribution and which are exempted. All renumeration or wages stated below and payable to staff workers are subject to socso contributions.

Director fee is like a project basis fee. This is usually the date of the company s annual general meeting or when the director s fee is approved by the board of the company. Where director s fee is taxable in singapore it will be treated as income of the year in which you are entitled to the fee.

But if you have never contributed before and your pay is above a certain amount rm3k if i remembered correctly then you can op not to. Salary wages full part time monthly hourly overtime payments commission paid.