Double Entry For Hire Purchase Of Motor Vehicle Malaysia

This matches the cost to purchase the van to the income associated with the expense.

Double entry for hire purchase of motor vehicle malaysia. The new motor vehicle 30 000 is brought into the business and the business makes a loss 1 000 on disposal of the old vehicle. Credit hire purchase company. The fixed assets were sold for 2 000.

You should consult your accountant if you have doubt in the accounting entries or classification of accounts. Purchased from maruti udyog ltd. Credit the old vehicle 17 000 11 000 and the cash 25 000 leave the business and are used to pay for the new motor vehicle.

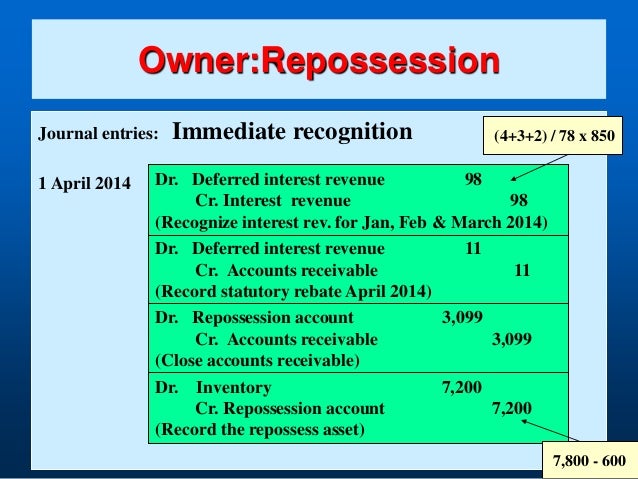

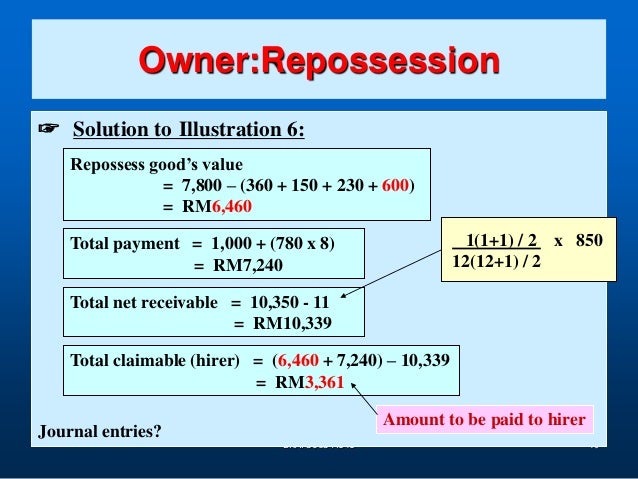

When purchasing a motor vehicle often we made a down payment deposit and arrange the balances with a car loan. Recording of the liability to the hire purchase company. Debit interest suspense balance sheet current liability type.

Delhi tourist service ltd. Vehicles are usually afforded a five year life. Assuming you purchase a motor vehicle at s 80 000 00 s 85 600 00 with gst and you paid s 10 000 00 as a down payment and take a loan for the remaining amount.

Such transfer assignment of the title to goods is not treated as a. Use the purchase invoice transaction to recor. The purchase was on hire purchase basis rs 50 000 being paid on the signing of the contract and thereafter rs 50 000 being paid annually on 31st march for three years interest was charged at 15 per annum.

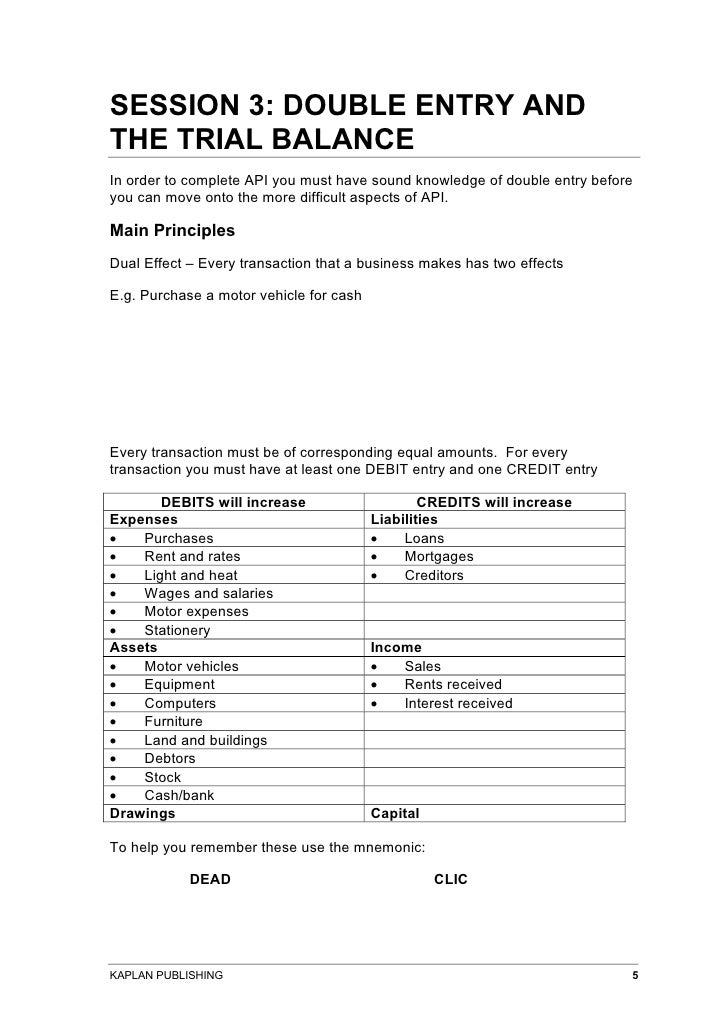

The double entry of this bill debits the hire purchase current account and credit accounts payable or bank account if write cheque is used instead of the enter bill transaction. This in itself is straight forward. To accomplish this we need to make an entry to account for depreciation.

Transfer to hire purchase creditor account. A business has fixed assets that originally cost 9 000 which have been depreciated by 6 000 to the date of disposal. When the hire purchase has been approved transfer from account payable to hire purchase creditor.

How do you record the disposal of fixed assets in the following situations. The double entry will be. Disposal of fixed assets double entry example.

Debit contra bank account balance sheet bank account type. Next pass a journal to transfer the amount from contra bank account to your hire purchase creditor account. The double entry will be.

A motor van on 1st april 2009 the cash price being rs 1 64 000. When i pay the down payment debit account payable 20 000 credit bank 20 000. When the financier transfers assigns the instalment credit facility in a hire purchase agreement to another financier such a transfer or assignment is an exempt supply hence no gst will be levied.

But in book keeping we need to capitalise the asset at cost i e. Net of the interests and state the liability to the hire purchase company in full i e. The financier would also transfer assign the title to goods when he assigns the hire purchase agreement to the new financier.