Yes yes no no indicate x in the relevant box k2.

Disposal of asset under the real property gains tax act 1976 什么意思. Disposal of asset under the real property gains tax act 1976 1 disposal of asset under the real property gains tax act 1976. Except for some pre cgt shares in private companies or pre cgt interests in private trusts where a combination of factors can occasionally trigger a cgt event giving rise to a taxable capital gain see taxation ruling tr 2004 18 income tax. If you have not disposed or sold any real estate just select tidak.

Similar allowances are in effect for calculating taxable income for provincial purposes. Capital cost allowance cca is the means by which canadian businesses may claim depreciation expense for calculating taxable income under the income tax act canada. Any disposal of asset.

What most people don t know is that rpgt is also applicable in the procurement and disposal of shares in companies where 75 of. Long term gains are subject to tax rates of 0 15 or 20 percent in 2018 for sole proprietors and investors. Application of cgt event k6 about pre cgt shares and pre cgt trust interests in section 104 230 of the income tax assessment act 1997.

Below that you will see melupuskan asset di bawah akta cukai keuntungan harta tanah 1976 which refers to any disposal of assets under the real property gains tax rpgt 1976. Additionally you can read up about rpgt at the lhdn website.

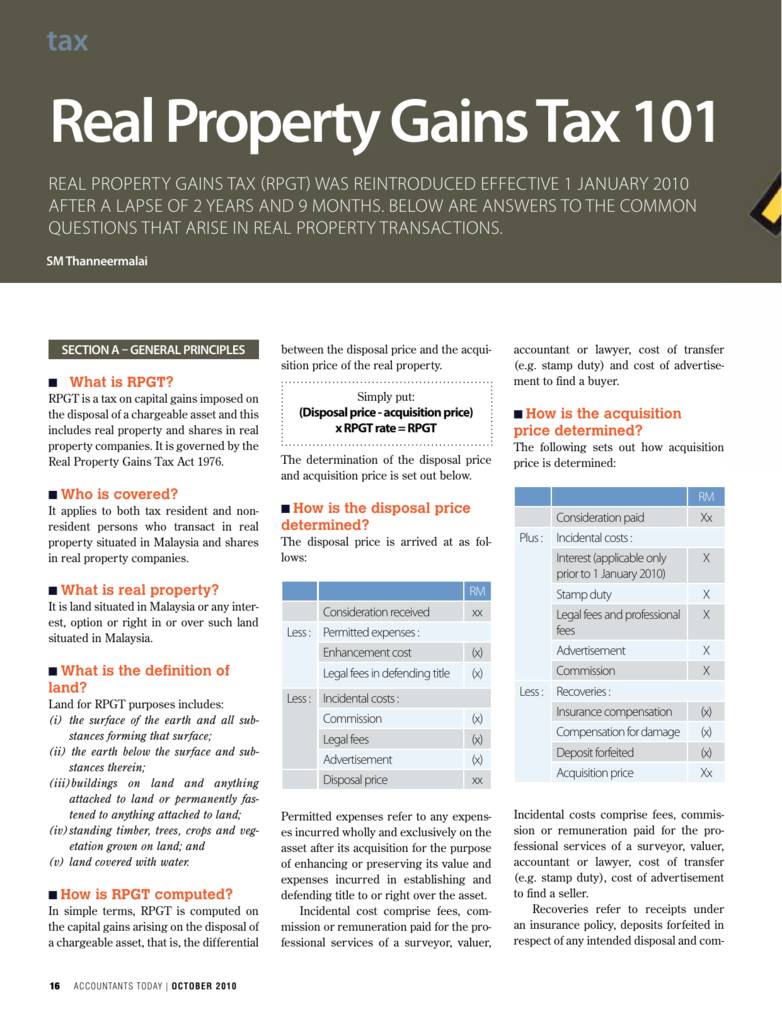

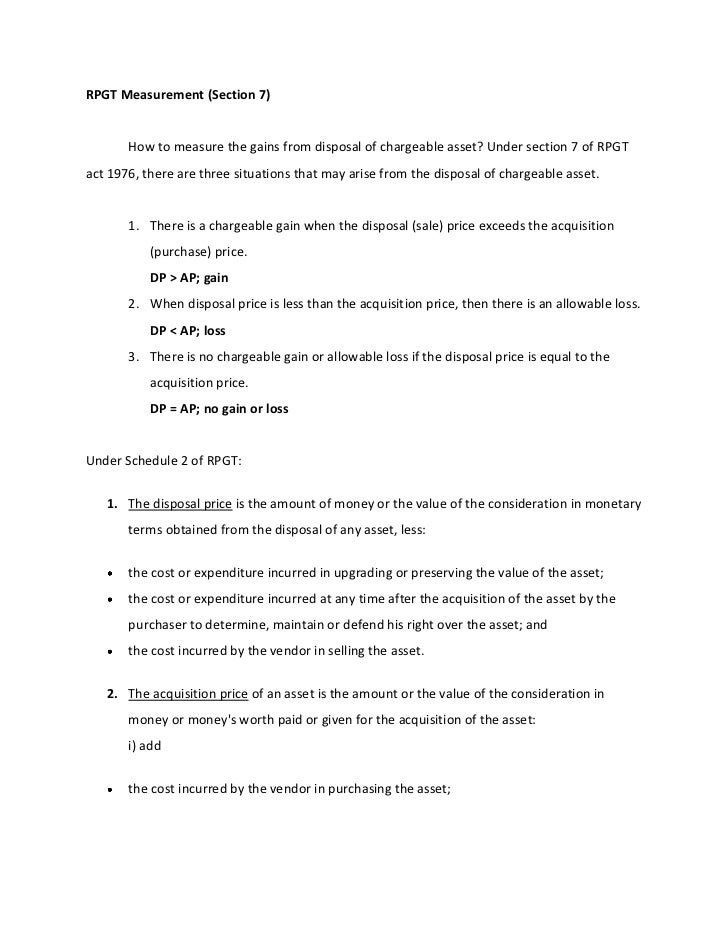

If k1 yes business income. A chargeable gain is the profit when the disposal price is more than purchase price of the property. It is governed under real property gains tax act 1976.

As we have observed there are many chinese companies and individuals investing real properties in malaysia. Real property gains tax malaysian real property gains tax rpgt is a tax imposed on any gains derived from the disposal of real property or shares in a real property company. Short term gains are taxed as ordinary income according to the individual s tax bracket.

If yes also complete item f2. Disposal of asset under the real property gains tax act 1976. Gains from the difference between historical cost and market value of the ip will be charged to the income statement.

Gains taken to the income statement is chargeable to real property gain tax rpgt subject to the holding period.