Director Fee Subject To Pcb

Employers are legally required to contribute epf for all payments of wages paid to the employees.

Director fee subject to pcb. If an employee has opted to contribute he she and the employer are liable to contribute and not allowed to revoke the option made. For a working director directors fee is a planning tool. You need to give numbers for people advise accurately.

Payment of handphone and pager allowances to employees yes payment of handphone and pager charges directly to third party e g. 8 january 2020 handphone and pager expenses is cpf payable. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time.

Director s fee fee paid to the director. My monthly pcb income tax is increased much since march 2009 hr told me that malaysia monthly income tax pcb deduction rate is changed since year 2009. Other income is taxed at a rate of 30.

Nonresidents are subject to withholding taxes on certain types of income. Income tax pcb calculation. Personal income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective year of assessment 2020.

Year 2009 onward director s fee or bonus is receivable in respect of the whole or parts of the relevant period the fee or bonus when receive in relevant period shall be treated as gross income in the year of receipt. This is usually the date of the company s annual general meeting or when the director s fee is approved by the board of the company. Find your pcb amount in this income tax pcb 2009 chart.

Tax implications of director s fee a. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020. Director salary bonus have to combo with kwsp which is good in a way that kwsp is tax exempted.

Residents and non residents are subject to tax on malaysian source income only. Try fully utilize sdn bhd lower band tax of 19. Do foreigner expatriate employees have to contribute epf.

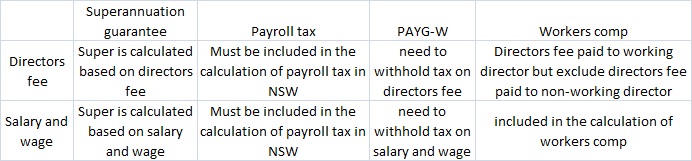

We carefully watch the payment of salary and wage to working director before year end. Calculate your taxable salary taxable salary gross salary epf. Where director s fee is taxable in singapore it will be treated as income of the year in which you are entitled to the fee.

Since you have secure your income you need to start to have proper tax planning. Scenario for bonus and director s fee payment and how to compute the mtd for year 2009 onward. Director fee is like a project basis fee.