Director Fee Subject To Epf

Wages subject to socso contribution.

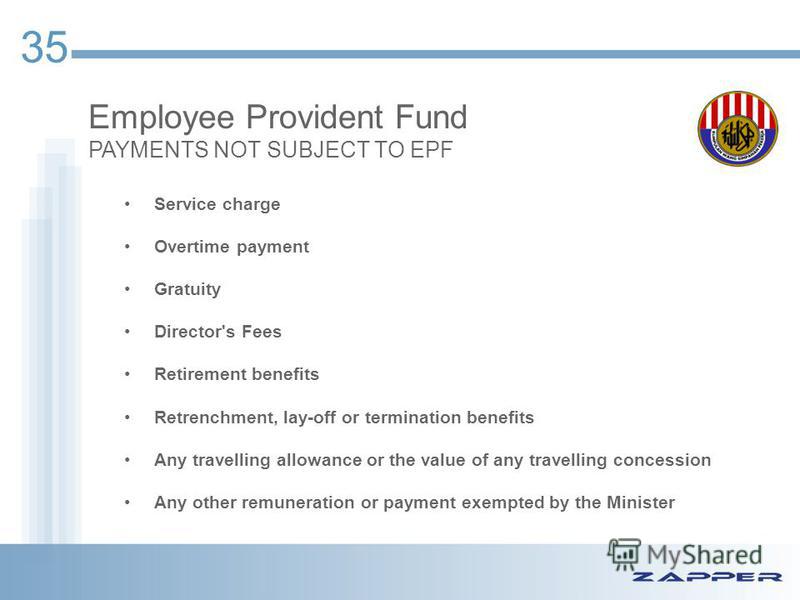

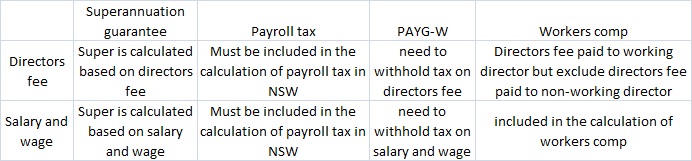

Director fee subject to epf. Epf socso payout on director is tax deductible as company expense. Yes pf contributions are not payable on directors fees voted to company directors at general meetings. Director s fee fee paid to the director.

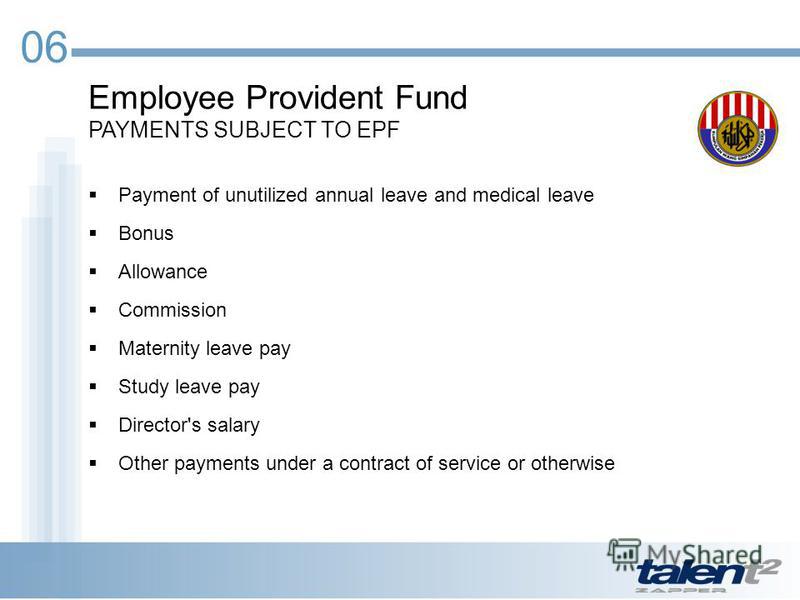

Gifts includes cash payments for holidays like hari raya christmas etc read more about. If an employee has opted to contribute he she and the employer are liable to contribute and not allowed to revoke the option made. In general all monetary payments that are meant to be wages are subject to epf contribution.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the third schedule. No concurrent employment is cpf payable. Epf contribution rates.

For payment of arrears of contributions employers are required to use the form epf 7 form e and form epf 8 form f except for contributions in respect of salary revision which are required to be paid together with the current monthly payment by using the same form epf 6 form a. A director can be employed in a dual capacity i e as a director who is the directing mind and will of the company and who can formulate and determine policies. Section 43 1 epf act 1991.

No non malaysian employees are not required to contribute but they are given the option to contribute. Directors of a company are considered employees if they are engaged under a contract of service and paid a salary on top of any directors fees received. Company directors is cpf payable.

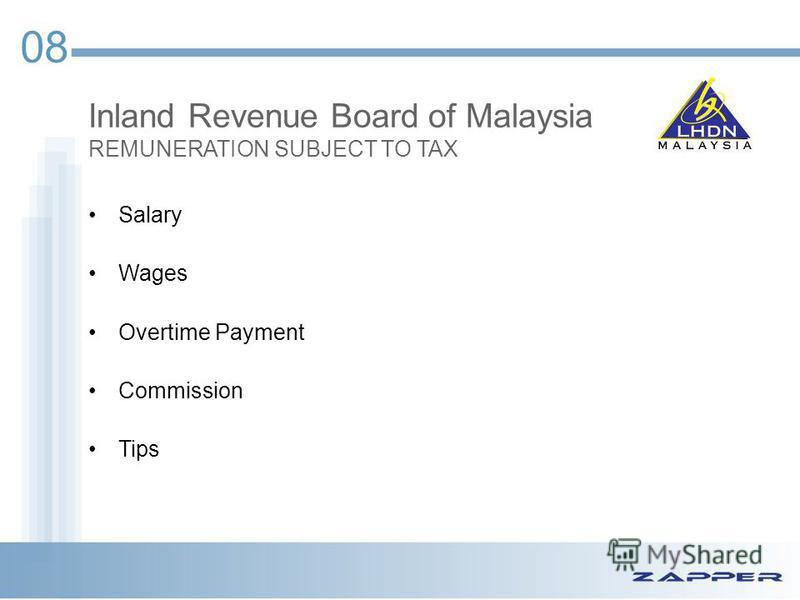

Not all wages payments to staff workers are subject to socso contribution and there are certain wages excluded from socso contribution. Salary wages full part time monthly hourly overtime payments commission paid. Late payment of contributions is subject to penalties.

Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. Cpf contributions are not payable on directors fees voted to them at general meetings. Company directors are considered employees if they are engaged under a contract of service and paid a salary on top of any fee received.

He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee. All renumeration or wages stated below and payable to staff workers are subject to socso contributions. Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit.

Do foreigner expatriate employees have to contribute epf. So it gives flexibility in term of amount when there is a profit or based on company profit level.