Director Fee Subject To Epf Socso And Pcb

Forever for unlimited employees.

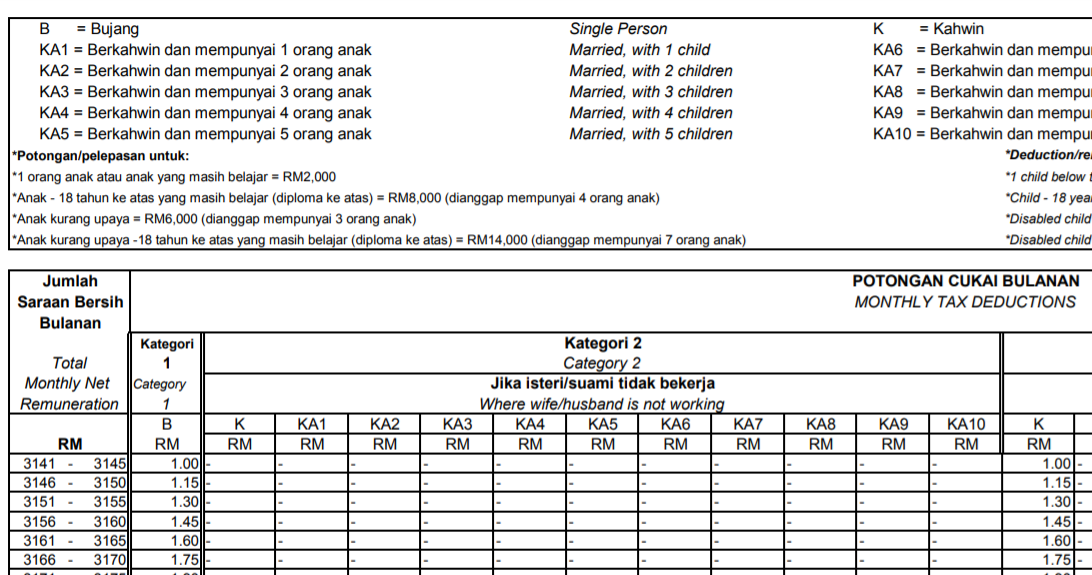

Director fee subject to epf socso and pcb. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. No non malaysian employees are not required to contribute but they are given the option to contribute. Do foreigner expatriate employees have to contribute epf.

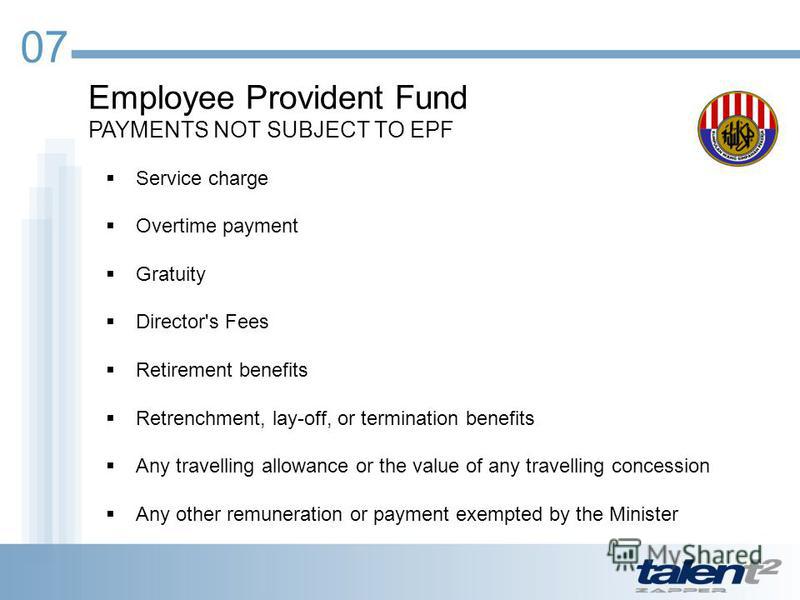

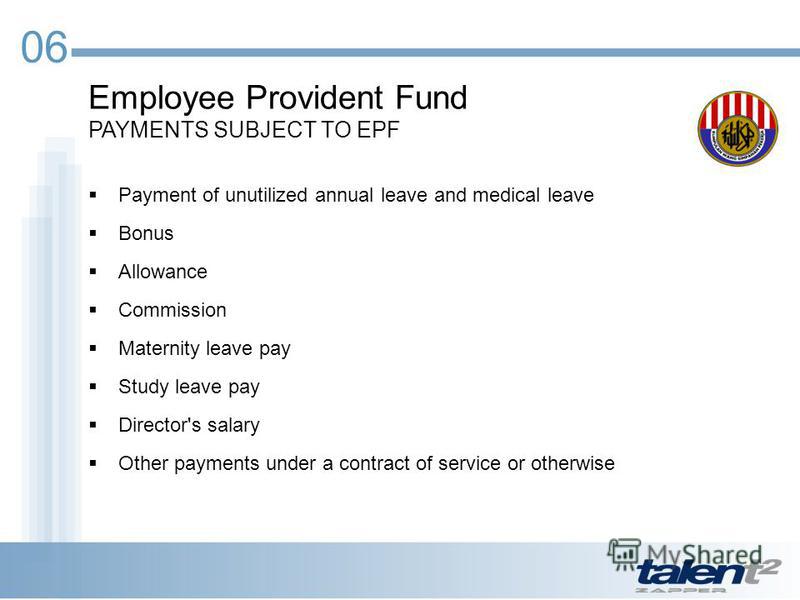

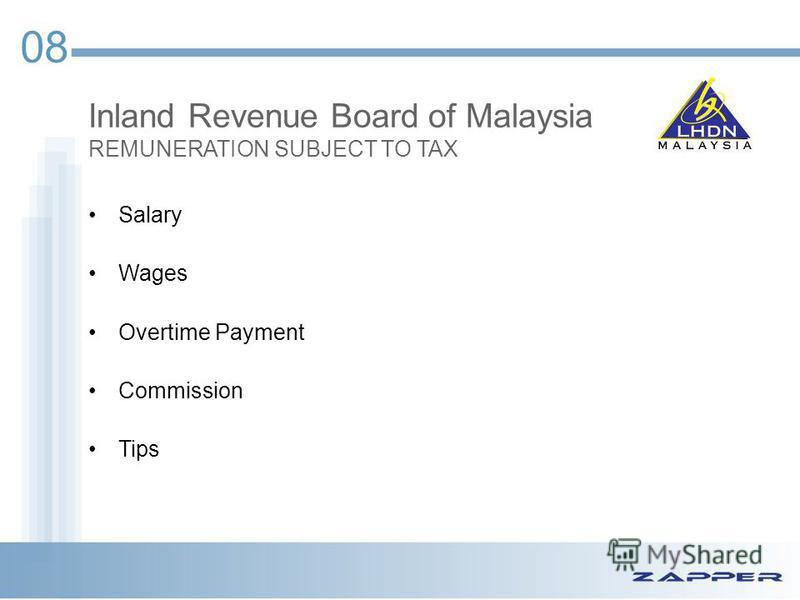

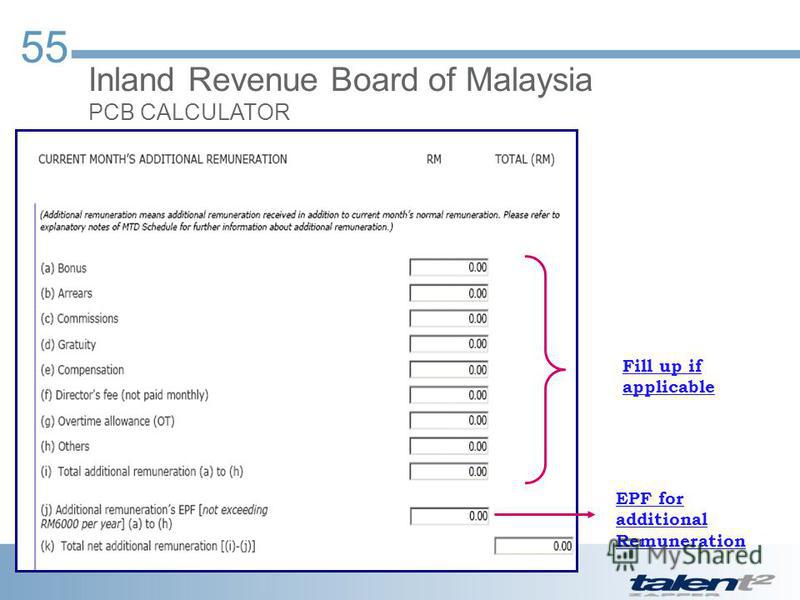

In general all monetary payments that are meant to be wages are subject to epf contribution. Salary wages full part time monthly hourly overtime payments commission paid. Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator.

Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit. Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. Employees provident fund act 1991.

Gifts includes cash payments for holidays like hari raya christmas etc read more about. So it gives flexibility in term of amount when there is a profit or based on company profit level. If you are wonder can a owner to contribute epf and his spouse then look no further on the contribution list.

Employers are legally required to contribute epf for all payments of wages paid to the employees. He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee. 6 september 2017.

A director can be employed in a dual capacity i e as a director who is the directing mind and will of the company and who can formulate and determine policies. Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018. Not all wages payments to staff workers are subject to socso contribution and there are certain wages excluded from socso contribution.

All renumeration or wages stated below and payable to staff workers are subject to socso contributions. Statutory contribution for owner spouse an act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. Epf contribution rates.

If you need more flexible and better payroll calculation such as generating ea form automatically or adding allowance that does not contribute to pcb epf or socso you may want to check out hr my free malaysian payroll and hr software which is absolutely free. Epf socso payout on director is tax deductible as company expense. If an employee has opted to contribute he she and the employer are liable to contribute and not allowed to revoke the option made.

Director s fee fee paid to the director.