Director Fee Subject To Epf Malaysia

Gifts includes cash payments for holidays like hari raya christmas etc read more about.

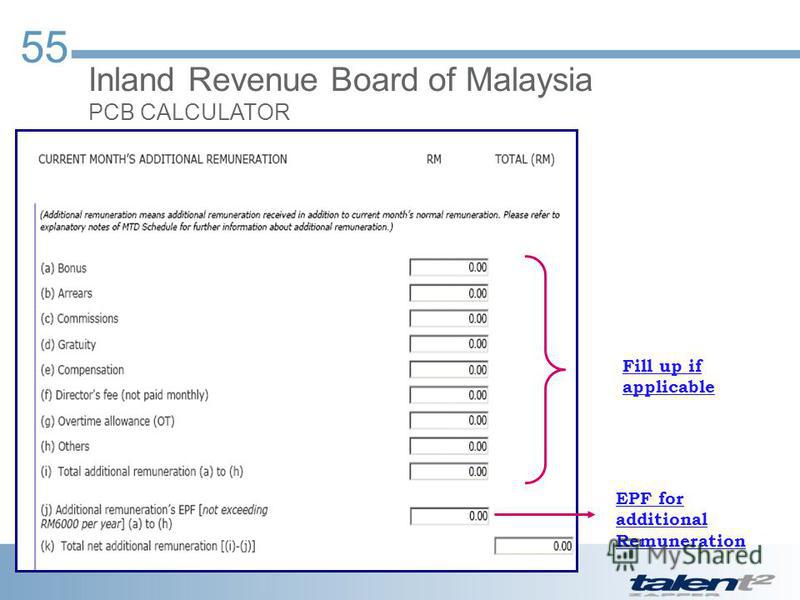

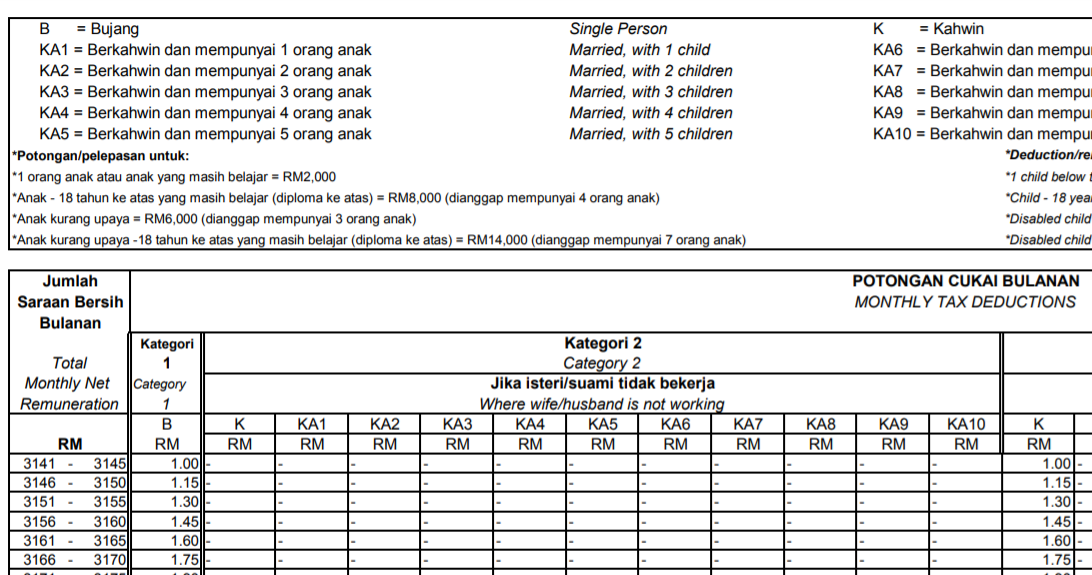

Director fee subject to epf malaysia. Wages subject to socso contribution. Where director s fee is taxable in singapore it will be treated as income of the year in which you are entitled to the fee. Section 43 1 epf act 1991.

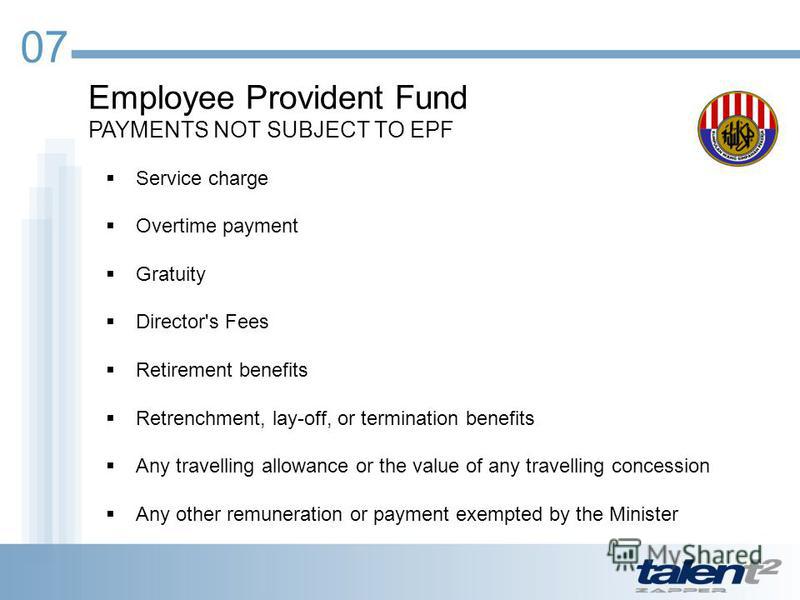

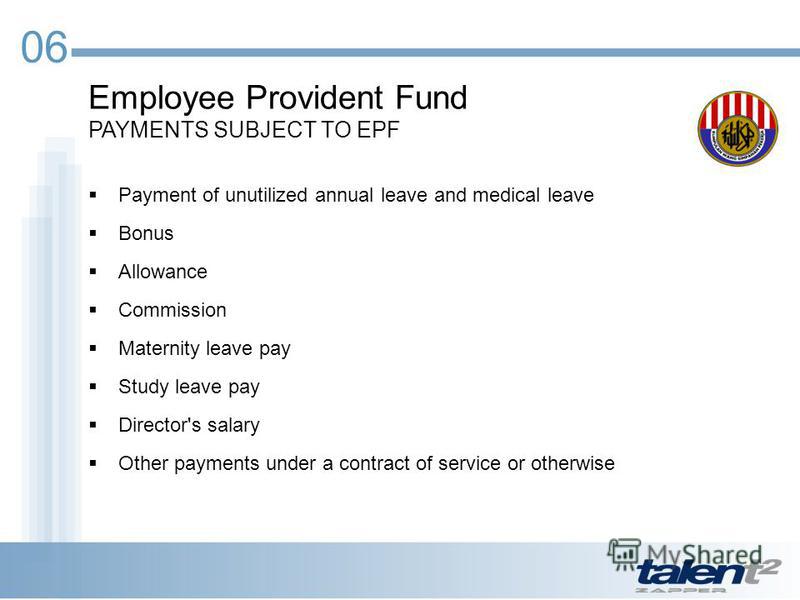

In general all monetary payments that are meant to be wages are subject to epf contribution. He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee. Epf temerloh now in new location starting from 21 sept.

A director can be employed in a dual capacity i e as a director who is the directing mind and will of the company and who can formulate and determine policies. Difference between director drawing salary vs director fee director fee once in a year so you only declare when there is profit. No 128b gf 1f and 2f and no 128a gf persiaran damai 1 damai court 28000 temerloh pahang more info.

Epf contribution rates. Plan your appointment with ease online. Faq set an appointment.

No non malaysian employees are not required to contribute but they are given the option to contribute. For payment of arrears of contributions employers are required to use the form epf 7 form e and form epf 8 form f except for contributions in respect of salary revision which are required to be paid together with the current monthly payment by using the same form epf 6 form a. Do foreigner expatriate employees have to contribute epf.

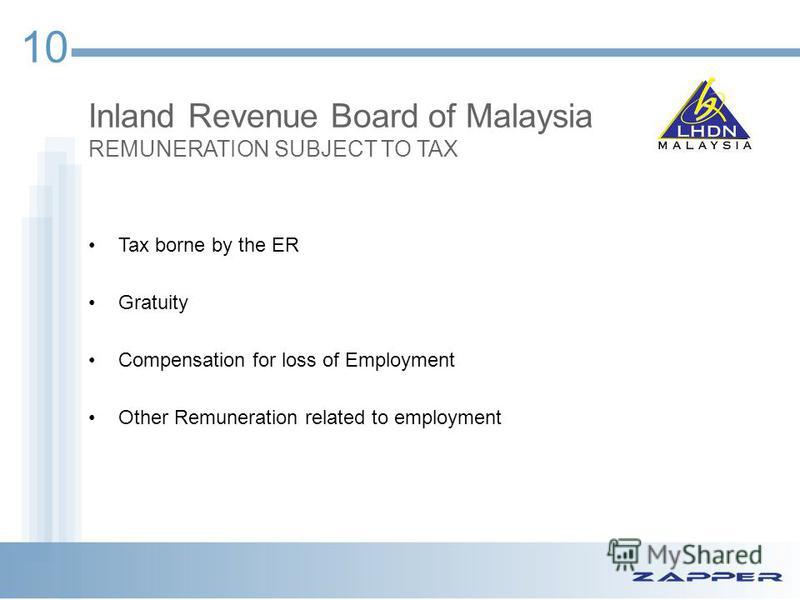

Under section 45 of the employees provident fund act 1991 epf act employers are statutorily required to contribute to the employees provident fund commonly known as the epf a social security fund established under the epf act to provide retirement benefits to employees working in the private sector. Epf socso payout on director is tax deductible as company expense. Tax implications of director s fee a.

Director s fee fee paid to the director. This is usually the date of the company s annual general meeting or when the director s fee is approved by the board of the company. 6 september 2017.

Late payment of contributions is subject to penalties. Salary wages full part time monthly hourly overtime payments commission paid. All renumeration or wages stated below and payable to staff workers are subject to socso contributions.

So it gives flexibility in term of amount when there is a profit or based on company profit level. Director salary fixed drawing every month.